Understanding Exness Limited and Exness CY: Your Guide to Trading Success

In the realm of online trading, choosing the right broker is paramount for success. Among the prominent players in the industry, exness limited or exness cy extrade-broker.com and Exness stand out. Exness Limited and Exness CY offer distinct features that cater to different trader preferences. This article delves into both entities, examining their offerings, regulatory environments, and the advantages they provide to traders.

Overview of Exness Limited

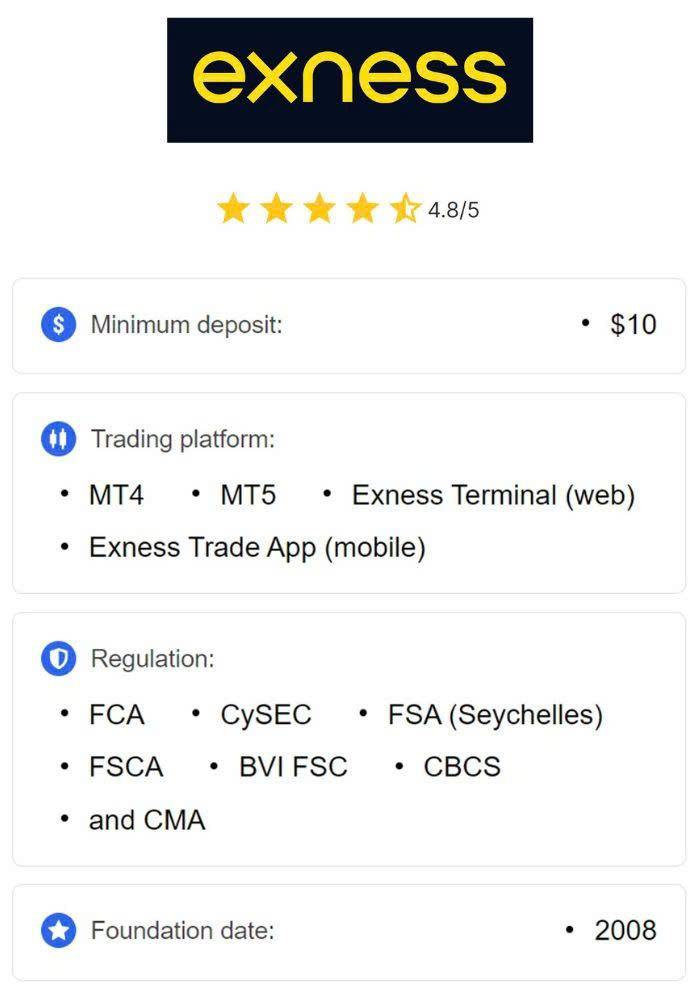

Founded in 2008, Exness Limited is a well-established broker based in the British Virgin Islands (BVI). It operates under the regulation of the BVI Financial Services Commission (BVIFSC). Exness Limited has gained a reputation for its user-friendly trading environment, offering a wide range of assets, including Forex, cryptocurrencies, commodities, and indices. Traders can leverage various instruments to implement diverse trading strategies.

Regulatory Environment

One of the critical aspects of trading with any broker is understanding the regulatory framework. Exness Limited, regulated by the BVIFSC, provides a certain level of assurance regarding the safety and security of funds. However, it’s important to note that BVI regulations are considered to be less stringent compared to those in the European Union or other jurisdictions. Therefore, traders should weigh the benefits of trading with a less regulated entity against the potential risks involved.

Trading Conditions

Exness Limited offers competitive trading conditions that can be appealing to both beginners and experienced traders. It provides various account types, each catering to different trading strategies and experiences. The minimum deposit requirement is relatively low, making it accessible for novice traders. Spreads start tight, and leverage can go up to 1:2000, allowing traders to amplify their positions significantly.

Exness CY: A Regulated Option for EU Traders

Unlike Exness Limited, Exness CY operates under the regulatory supervision of the Cyprus Securities and Exchange Commission (CySEC). Established in 2013, this branch of Exness is focused on providing services to European clients. With CySEC regulation, Exness CY adheres to higher standards of compliance, which includes the protection of client funds, ensuring that they are held in segregated accounts.

Regulatory Assurance

The regulatory framework of CySEC is considered robust. Traders using Exness CY benefit from the Investor Compensation Fund (ICF), which offers additional security by compensating clients in the event of broker insolvency. The assurance of regulatory compliance enhances the credibility of Exness CY and provides peace of mind for European traders concerned about the safety of their investments.

Wide Range of Trading Instruments

Exness CY offers a broad spectrum of trading instruments, similar to its counterpart Exness Limited. Clients can trade Forex, commodities, cryptocurrencies, and indices, giving them ample choices to construct diversified portfolios. The accessibility of diverse instruments allows traders to switch strategies based on market conditions effectively.

Account Types and Trading Features

Both Exness Limited and Exness CY offer multiple account types tailored to suit various trader preferences. Exness CY provides accounts like Standard, Pro, and ECN accounts, each with distinct features. For example, the Pro account is suited for advanced traders requiring tighter spreads, while the Standard account is designed for new traders seeking simplicity.

Customer Support

Effective customer support is a crucial element in any trading platform. Both Exness Limited and Exness CY take customer service seriously, offering support in multiple languages through various channels, including live chat, email, and phone support. Additionally, their educational resources, including webinars and articles, help traders improve their skills and knowledge.

Choosing the Right Option: Exness Limited vs. Exness CY

Traders must carefully consider their individual needs when choosing between Exness Limited and Exness CY. If you’re an EU-based trader prioritizing regulatory protection, Exness CY may be the better option with its CySEC oversight. Conversely, traders from regions outside the EU may benefit from the flexible trading conditions of Exness Limited, particularly if they prefer lower deposit requirements.

Conclusion

In conclusion, both Exness Limited and Exness CY present valuable opportunities for traders worldwide. While Exness Limited offers flexibility in trading conditions with less stringent regulation, Exness CY ensures higher regulatory standards and added safety for traders within the EU. Ultimately, the decision between the two will depend on individual preferences, trading strategies, and the importance of regulatory oversight in one’s trading journey. By evaluating these factors, traders can make informed decisions that align with their trading goals.