Mastering the Art of Forex Trading

Forex trading, also known as foreign exchange trading, is the process of buying and selling currency pairs in a decentralized global market. This market operates 24 hours a day, making it one of the most accessible and liquid financial markets in the world. For those looking to delve into Forex trading, understanding the strategies and tools available can significantly enhance your chances of success. Take the first step by exploring forex trading website https://kuwait-tradingplatform.com/, where you can find essential resources to guide your journey.

Understanding the Forex Market

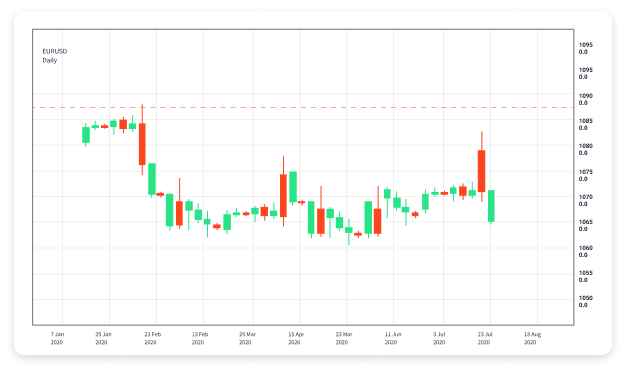

The foreign exchange market involves trading different currencies against one another. Currency pairs are categorized as major, minor, and exotic pairs. Major pairs, such as EUR/USD and USD/JPY, involve the most significant and liquid currencies in the world. Minor pairs, like GBP/AUD and NZD/CHF, are less widely traded but still offer opportunities for profit. Exotic pairs involve a challenging mix of major currencies with those from emerging markets.

Currency Pairs

Understanding currency pairs is fundamental to Forex trading. Each pair consists of a base currency and a quote currency. The base currency is the first currency listed in the pair, and the quote currency is the second. For example, in the EUR/USD pair, the euro is the base currency, while the US dollar is the quote currency. Currency pairs are quoted with a bid price, the price at which you can sell the base currency, and an ask price, the price at which you can buy the base currency.

Key Concepts in Forex Trading

Leverage

One of the most attractive features of Forex trading is the ability to trade on margin. Leverage allows traders to control a large position with a relatively small amount of capital. For instance, if your broker offers a leverage of 100:1, you can control a $100,000 position with just $1,000. However, while leverage can amplify profits, it also increases risk, and traders should be cautious with their use of leverage.

Pips and Spreads

Pips (percentage in point) are the smallest price change between two currencies. In most currency pairs, a pip is worth 0.0001. Understanding how to calculate pips and spreads—the difference between the bid and ask price—is crucial for determining your potential profit or loss and for developing effective trading strategies.

Effective Trading Strategies

Successful Forex traders employ various strategies to maximize their earning potential. Here are a few popular strategies that you can consider:

Day Trading

Day trading is a strategy where traders buy and sell currency pairs within a single trading day. Day traders capitalize on small price movements, holding positions for minutes to hours. This approach requires real-time analysis and quick decision-making, often relying on technical indicators for entry and exit points.

Swing Trading

Swing trading involves holding positions for several days or weeks, aiming to benefit from expected price changes. Swing traders typically analyze price patterns and utilize technical analysis to identify potential trends. This strategy allows traders to focus on larger price movements without the pressure of making rapid trades.

Scalping

Scalping is a short-term strategy where traders aim to make numerous small profits throughout the day. Scalpers often rely on technical analysis and high-frequency trading to achieve their goals. This method requires precise execution and a strong understanding of market dynamics.

Utilizing Technical and Fundamental Analysis

Technical Analysis

Technical analysis is the study of historical price movements and chart patterns to predict future price actions. Traders often use various tools, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), to identify buying or selling opportunities. Learning to interpret charts and understand indicators is essential for successful technical analysis.

Fundamental Analysis

Fundamental analysis involves examining economic indicators, geopolitical events, and news releases that may impact currency prices. Traders must stay updated on economic reports, such as Gross Domestic Product (GDP), unemployment rates, and interest rate decisions. Understanding how these factors influence currency movements can give traders an edge in the market.

Risk Management

Risk management is a critical aspect of Forex trading. Successful traders must implement strategies to protect their capital and minimize risks. Some common risk management techniques include:

- Setting stop-loss orders to automatically exit losing trades.

- Using position sizing to control exposure to each trade.

- Diversifying your trading portfolio to spread risk across multiple currency pairs.

Choosing the Right Broker

Selecting a reputable Forex broker is essential for your trading success. Factors to consider when choosing a broker include:

- Regulatory compliance: Make sure the broker is regulated by a recognized authority.

- Trading platform: Evaluate the broker’s trading platform for user-friendliness and available tools.

- Fees and commissions: Understand the spreads, commissions, and any other fees associated with trading.

Continuous Learning and Adaptation

Finally, successful Forex trading requires ongoing education and adaptability. The Forex market is ever-changing, influenced by economic trends, policies, and global events. Traders should continuously update their knowledge, refine their strategies, and adapt to market conditions.

Conclusion

Forex trading can be a profitable and rewarding venture if approached with the right mindset and strategies. By understanding the market dynamics, employing effective trading techniques, and managing risks wisely, you can navigate the complexities of Forex trading with confidence. Whether you are a novice trader or an experienced investor, embracing continuous learning and adaptation will ultimately lead to your success in this dynamic financial marketplace.