The world of Forex currency trading online offers unparalleled opportunities for investors and traders seeking to capitalize on the fluctuations of currency values. With the right strategies and tools, anyone can become a proficient trader in this dynamic market. In this article, we will explore various aspects of Forex trading, including essential strategies, tips for success, and the best resources to get started. We’ll also provide insights on the forex currency trading online Best Trading Apps that can help streamline your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, represents the largest financial market in the world, trading over $6 trillion daily. Unlike stock markets, Forex trading occurs 24/5, making it accessible for traders across the globe. Currencies are traded in pairs (e.g., EUR/USD), with one currency’s value being determined in relation to another. This trading can be speculative — allowing traders to profit from currency fluctuations — or hedging against risk.

Getting Started with Forex Currency Trading

To begin trading currencies, traders need to understand several fundamentals. Here are the steps to kickstart your Forex trading journey:

- Educate Yourself: Learn about currency pairs, pips, spreads, and market analysis. Online courses and tutorials can provide a solid foundation.

- Select a Reliable Broker: Choose a brokerage that aligns with your trading goals. Ensure they are regulated and offer competitive spreads and fees.

- Create a Trading Plan: Outline your goals, risk tolerance, and strategies. A clear plan helps in making informed decisions under pressure.

- Demo Trading: Before risking real money, practice with a demo account. This allows you to familiarize yourself with the trading platform without financial risk.

- Start Trading with Real Money: When you’re confident, you can transition to a live account and start trading with real funds.

Strategies for Successful Forex Trading

Successful Forex trading does not happen by chance. It requires careful analysis, risk management, and a strategic approach. Here are a few popular strategies:

1. Technical Analysis

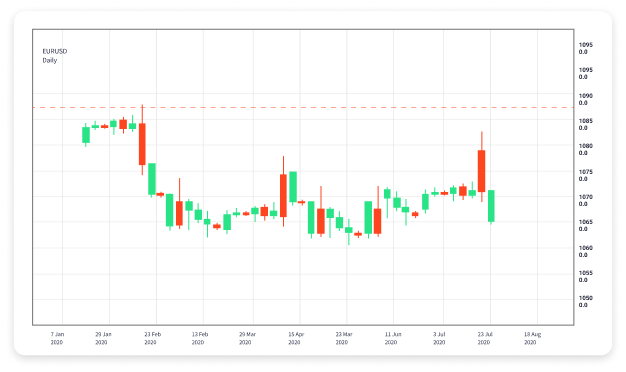

This strategy focuses on analyzing statistical trends from trading activity, such as price movement and volume. Traders use charts, indicators, and patterns to predict future market behavior. Popular tools include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

2. Fundamental Analysis

Fundamental analysts study economic indicators, interest rates, and geopolitical events that may affect currency values. For instance, monitoring inflation rates, employment figures, and central bank policies can help predict currency movements.

3. Price Action Trading

Price action trading involves making decisions based solely on the price movement of a currency pair, without relying on indicators. Traders often look for patterns such as support and resistance levels to make trading decisions.

4. Scalping

Scalping is a short-term trading strategy that involves making numerous trades throughout the day to capitalize on small price movements. This requires quick decision-making and a well-defined exit strategy.

5. Swing Trading

In swing trading, traders hold positions for several days or weeks in an effort to capture larger price moves. This strategy requires less frequent monitoring compared to scalping but needs a solid understanding of market trends.

Risk Management in Forex Trading

Proper risk management is vital to long-term success in Forex trading. Here are some key practices:

- Setting Stop-Loss and Take-Profit Orders: Use stop-loss orders to limit potential losses and take-profit orders to secure gains when your target is reached.

- Position Sizing: Determine how much of your capital to risk on each trade. A common guideline is to risk no more than 1-2% of your trading capital on a single trade.

- Use Leverage Wisely: While leverage can magnify profits, it can also amplify losses. Use it judiciously and be aware of the risks involved.

The Role of Trading Apps

In today’s fast-paced trading environment, having the right tools at your disposal is critical for success. Trading apps have revolutionized how traders access the Forex market. Here are some benefits of using trading apps:

- Accessibility: Trade from anywhere at any time with mobile trading apps.

- Real-Time Data: Get instant access to market data, news, and updates to make well-informed decisions.

- Technical Tools: Utilize built-in charting tools, indicators, and analysis features to enhance your trading strategy.

Choosing the right trading app can profoundly impact your performance as a Forex trader. That is why it is essential to consider factors such as the app’s user interface, available features, security protocols, and customer support.

Conclusion

Forex currency trading online offers immense potential for those willing to invest time and effort into understanding the market. By learning the fundamentals, practicing effective strategies, and implementing robust risk management, traders can thrive in this fast-paced environment. Whether you are a novice or a seasoned trader, stay informed and adaptable to navigate the complexities of the Forex market successfully. Embrace technological advancements and explore the Best Trading Apps to enhance your trading experience and achieve your financial goals.