Forex Trading for Beginners: A Comprehensive Guide

Forex trading, also known as foreign exchange trading, is the process of exchanging one currency for another. For beginners, the forex market can seem overwhelming, with its myriad terms, concepts, and trading strategies. However, with a foundational understanding and proper guidance, anyone can embark on their forex trading journey. In this article, we’ll explore the essential aspects of forex trading for beginners, including basic concepts, tips, and strategies to help you succeed. To kickstart your journey, consider exploring the forex trading for beginners Best Indonesian Brokers that can offer valuable resources and support.

What is Forex Trading?

Forex trading involves buying and selling currencies in pairs. These pairs are categorized into three types: major pairs (like EUR/USD), minor pairs (like GBP/CAD), and exotic pairs (like USD/THB). The goal is to speculate on currency fluctuations, aiming to profit from the differences in exchange rates. Forex trading is known for its high liquidity, meaning trades can be executed quickly, and there are numerous opportunities for profit.

The Basics of Currency Pairs

In the forex market, currencies are always traded in pairs. Each pair consists of a base currency and a quote currency. The base currency is the first currency listed in the pair, while the quote currency is the second. For instance, in the EUR/USD pair, the Euro is the base currency, and the US Dollar is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Understanding Bid and Ask Prices

The bid price is the price at which a trader can sell a currency pair, while the ask price is the price at which a trader can buy it. The difference between the bid and ask price is known as the spread, which signifies the transaction cost of trading. Understanding these terms is crucial for effectively executing trades.

Key Terminology in Forex Trading

Familiarizing yourself with common forex terminology will aid your trading experience. Here are some key terms:

- Pips: The smallest price movement in a currency pair, typically the fourth decimal place.

- Leverage: The ability to control a larger position with a smaller amount of capital, allowing for greater potential profits (and risks).

- Margin: The amount of money required to open and maintain a leveraged position.

- Lot: A standard unit used to measure the size of a trade. A standard lot is typically 100,000 units.

- Order Types: Different ways to execute trades, including market orders, limit orders, and stop-loss orders.

Developing a Trading Strategy

A solid trading strategy is crucial for success in forex trading. Here are some fundamental components to consider when developing your strategy:

1. Define Your Goals

Determine your financial objectives and risk tolerance. Knowing how much you’re willing to risk and what you hope to achieve will guide your trading decisions.

2. Choose a Trading Style

There are several trading styles, including day trading, swing trading, and scalping. Each has its own time commitment and risk factors.

3. Utilize Technical Analysis

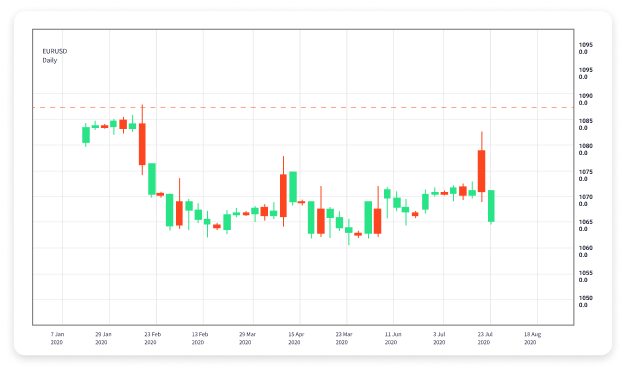

Technical analysis involves studying price charts and using indicators to forecast future price movements. Learning to read charts and understanding key indicators can enhance your trading effectiveness.

4. Practice Risk Management

Implementing risk management strategies is essential to protect your capital. Use stop-loss orders to limit potential losses and calculate the appropriate position size based on your risk tolerance.

The Importance of Fundamentals

While technical analysis is critical, understanding fundamental factors that influence currency movements is equally important. Economic indicators such as interest rates, employment data, and geopolitical events can significantly impact currency values. Stay informed on global news and economic forecasts to make educated trading decisions.

Choosing a Forex Broker

Selecting the right forex broker is a crucial step in your trading journey. Look for a broker that is regulated, has a user-friendly trading platform, and offers competitive spreads. Research different brokers and read reviews to find the one that aligns with your trading needs and objectives.

Practice with a Demo Account

Before risking real money, open a demo account with your chosen broker. A demo account allows you to practice trading with virtual funds while familiarizing yourself with the trading platform and testing your strategies. This is a valuable step for beginners to gain confidence and experience before entering the live market.

Continuous Learning and Adaptation

The forex market is constantly evolving. Stay updated on market trends, news events, and changes in economic indicators. Join trading forums, attend webinars, and read books on forex trading to continuously enhance your knowledge and skills. Adapt your strategies as you gain more experience and insights into the market.

Conclusion

Forex trading offers exciting opportunities for beginners willing to learn and adapt. By understanding key concepts, practicing with a demo account, and continually educating yourself, you can effectively navigate the forex market. Remember to set realistic goals, manage your risk, and stay informed to increase your chances of success in this dynamic trading environment. As you embark on your trading journey, don’t hesitate to seek guidance from resources and platforms that cater to new traders.